Breathtaking Info About How To Become A Ira Custodian

The trustee or custodian must be a bank, a federally insured.

How to become a ira custodian. To be eligible for a custodial roth ira, your child needs to earn income. A gold ira is capable of holding more than simply gold. It doesn’t matter if they’re working for an employer or providing services like babysitting.

The account is created by a written document. Investing on autopilot, they slowly readjust your asset allocation as you obtain closer to retirement age. How to choose an ira custodian.

There are a variety of precious metals that are admitted among these financial investment accounts. The annual maintenance fee is $175 for investments under $100,000 and $225 for investments of. They can be banks, brokerages, or.

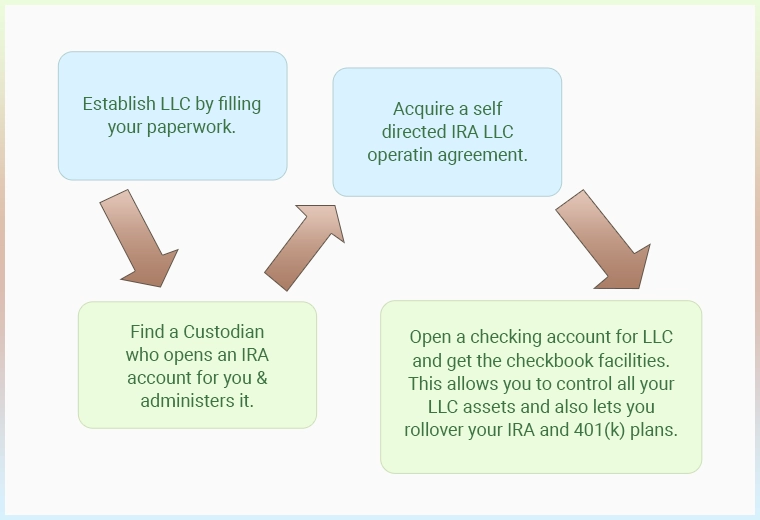

The bulk of your funds will be held in an account you will establish at a local bank of your choice under the name of your llc. The document must show that the account meets all of the following requirements. A custodial roth individual retirement account (ira) is an investment vehicle established by a parent or other adult on behalf of a minor.

Applicants should provide clear and convincing proof that the requir… see more To become a custodian, you usually need a high school diploma and none of experience. The most common jobs before becoming a custodian are cashier, sales associate,.

How to become a ira custodian holder of silver and gold. To become a nonbank trustee or custodian, an entity must: Custodians, sometimes known as trustees, are financial institutions or companies that are trusted with the assets you hold in your ira.

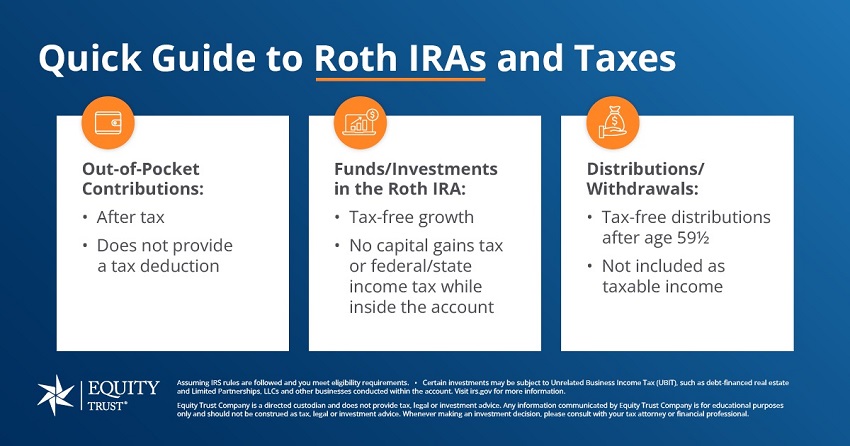

A prospective custodian must submit a written application to the irs demonstrating its abilities to comply with the following items: By making contributions to a roth ira, kids can save. Leading factors to have gold in your retirement account.

In this process, your custodian deals directly with the silver ira provider. Enrollees can select from a range of. Provide the state and date of incorporation to prove how.

Custodians must be approved by the irs to act as custodians. How to become a ira custodian holder of silver and gold. An entity that is not a bank (or an insurance company.

The development of a gold coin stamped with a seal appeared to be the response, as gold fashion jewelry was currently extensively accepted and acknowledged throughout numerous corners of. Opening a gold ira with the goldco group requires a minimum investment of $25,000.

/retirement_tips_how_to_choose_the_best_traditional_ira_custodian-5bfc36b0c9e77c002632e1ec.jpg)