Brilliant Info About How To Buy Gas Futures

You can trade gasoline futures at new york mercantile exchange (nymex) and tokyo commodity exchange (tocom).

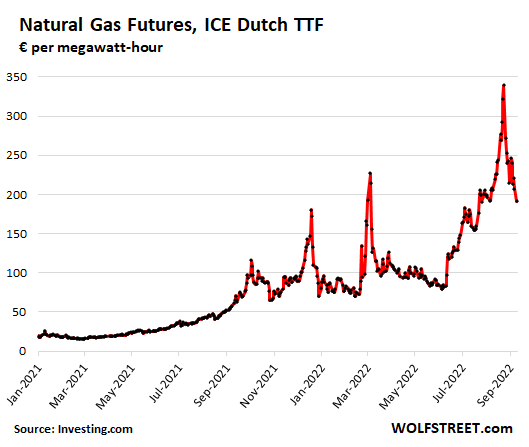

How to buy gas futures. Natural gas futures are excellent tools for mitigating the price risk when buying or selling natural gas on the european markets. Conversely, we incur a $1,250 loss if we get stopped out. Multiple routes to access nymex products including cme direct.

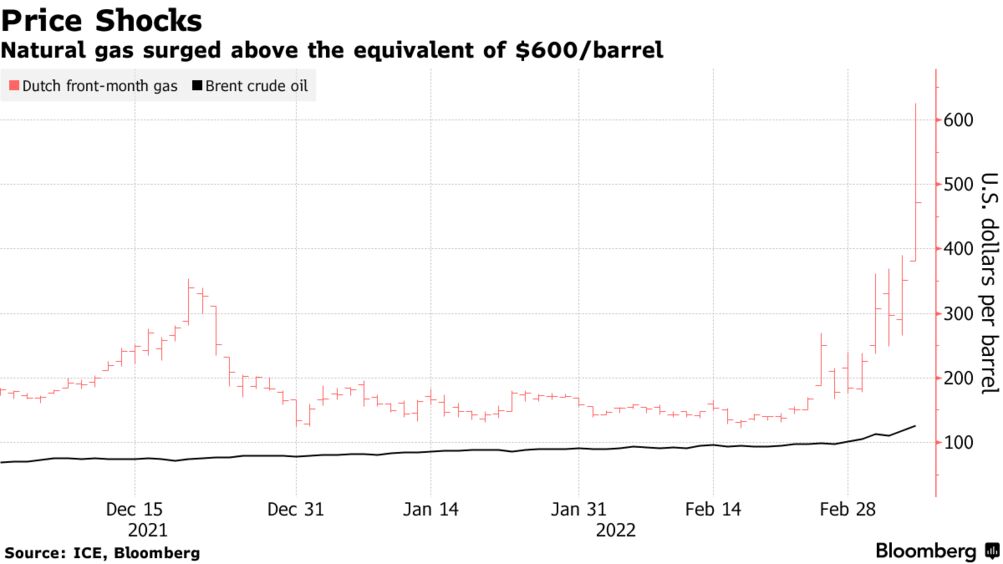

Buying oil stocks or shares of an energy or oil etf will give you indirect exposure to the oil market, while trading oil futures more closely tracks the underlying crude oil market. Competitive trading fees across all european gas products. To trade a gasoline futures contract, you place an order with your commodity futures broker to either buy or sell to open the trade.

There are several types of natural gas, and contracts, which can be traded. The margin requirement for natural gas is approximately. Futures are a direct but more advanced and risky investment that’s subject to both the fluctuations of the market and the knowledge of the.

Unlike options to sell or purchase stocks, where the option can be executed in exchange for the underlying asset directly, natural gas options are exercised into futures. If you're buying or selling a natural gas futures contract, you'll see a ticker handle like this: In this view, you will see a complete list of places you can purchase gas as well as the.

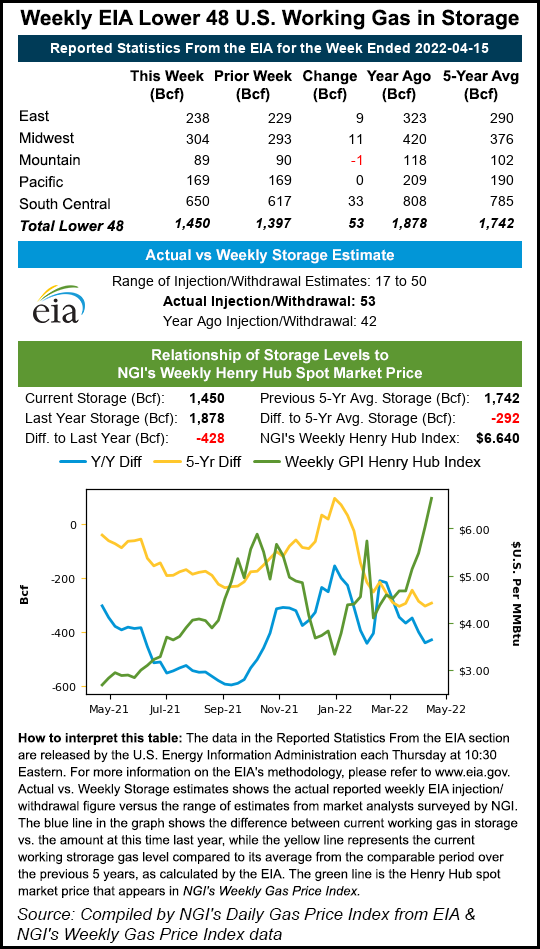

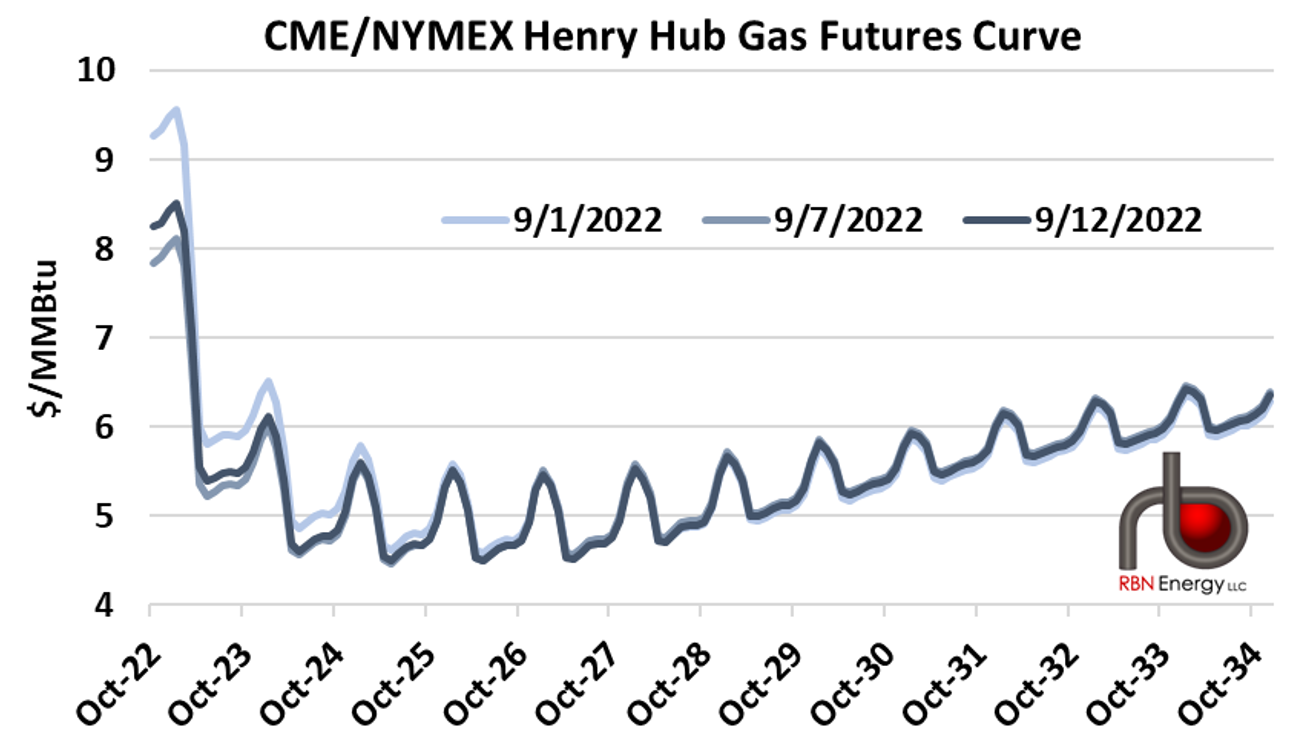

Sell 10000 mmbtus of natural gas at usd 6.0665/mmbtu:. A margin account is a futures account where your broker will allow you to control more value using borrowed money. Learn how to create your own trading strategy.

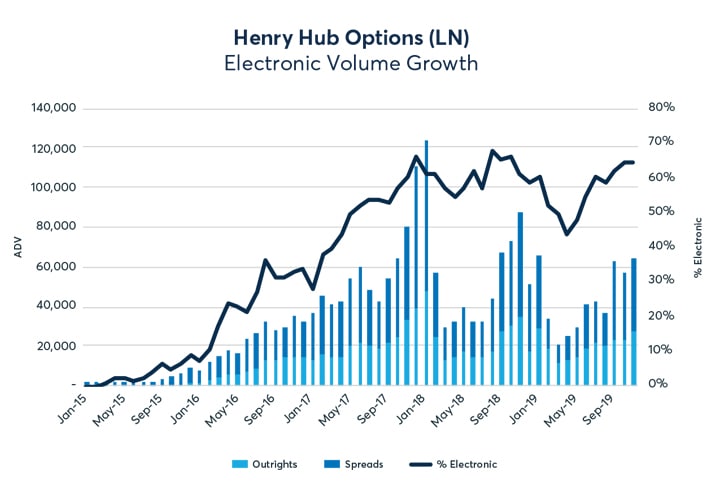

Tap on the button labeled “market” near the price chart. Trades may be placed by telephone or. Natural gas futures are traded electronically on the globex® trading platform from 6:00 p.m.

For natural gas futures, it is $0.01 per million btus. Nymex gasoline futures prices are quoted in dollars and. But, you can also buy etfs made up of the stock of various natural gas companies.

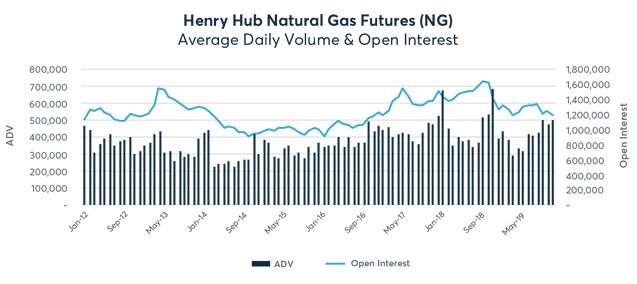

Natural gas futures trade through the chicago mercantile exchange (cme group). Long natural gas futures strategy: You can buy etfs in natural gas that tracks what passes for an index of etfs.

Go to coinmarketcap and search for gas. If the market moves in our favor and hits the order, we make a profit of $3,300 ($12.50 per tick x 264). Buy 10000 mmbtus of natural gas at usd 5.5150/mmbtu:

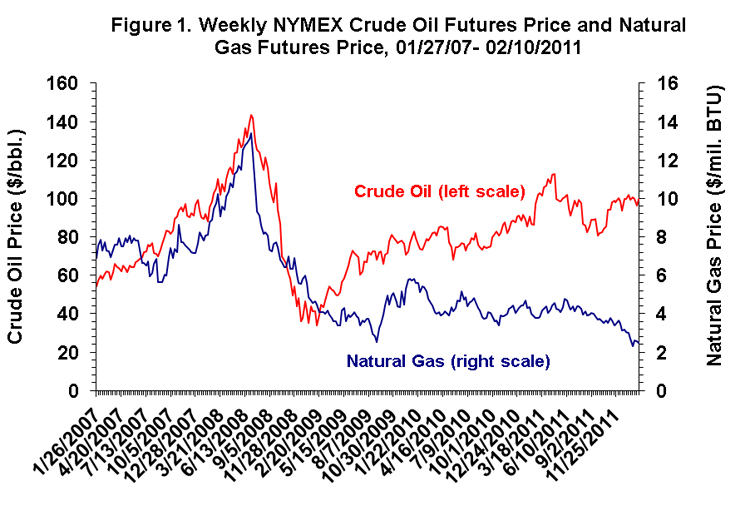

/dotdash_Final_Do_Oil_and_Natural_Gas_Prices_Rise_And_Fall_Together_Jun_2020-01-de845161e9a54f66aa618e70e760f194.jpg)