Who Else Wants Info About How To Keep Track Of Your Credit Score

A common tactic for people looking to boost their credit scores is to get an unsecured credit card.

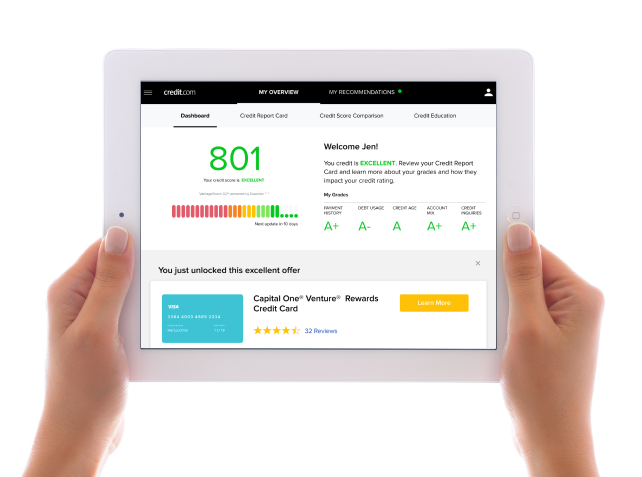

How to keep track of your credit score. One easy way to keep a track of your credit score is by checking in with your bank or lender directly. Ad increase your credit scores & get credit for the bills you're already paying. Subscribing to a free offering such as this will allow you to track your credit score more efficiently.

You can usually find out through your online account management portal. You, too, can directly pull your score to. Surprises on your credit report,.

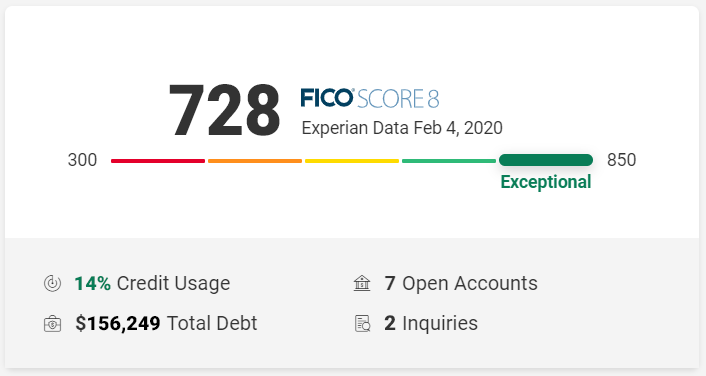

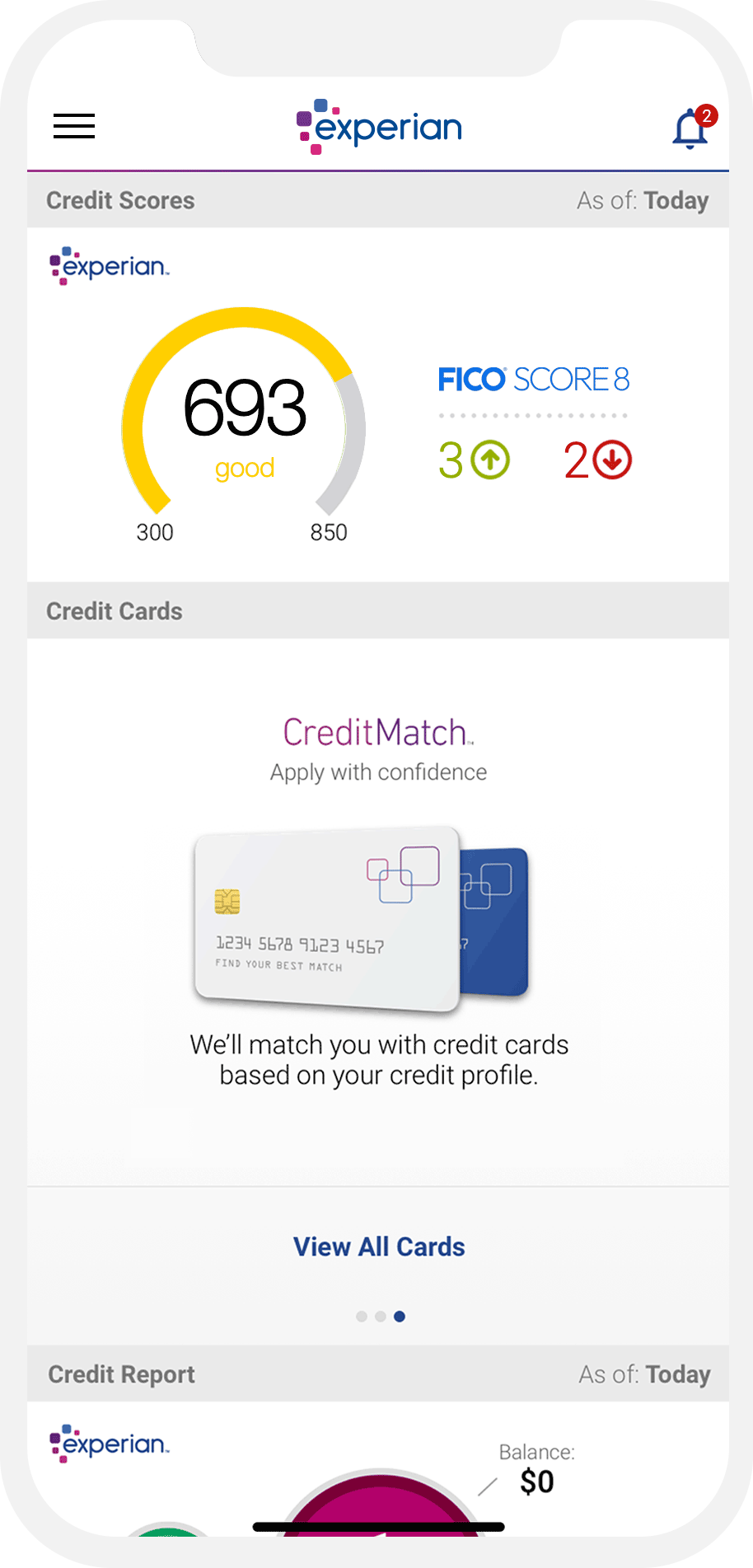

Credit confidence uses a vantagescore 3.0 credit score model, which is a credit score used by major credit bureaus. Your credit score is determined according to the information. Banks have recently begun providing credit scores to their.

It generally sits around 720, although you should check the details on the specific website you use to avoid confusion. Credit score tracker, view my credit history, best. Any lender or other interested person will pull your credit score from fico.

You can request for the score to be included with the free. If you use experian, for example, a good credit score is. The simplest way to track your credit score is through your free credit report each year.

In last week's post, we discussed creating a budget,. The first step is to monitor your credit score. For convenience, there are even online services that will.

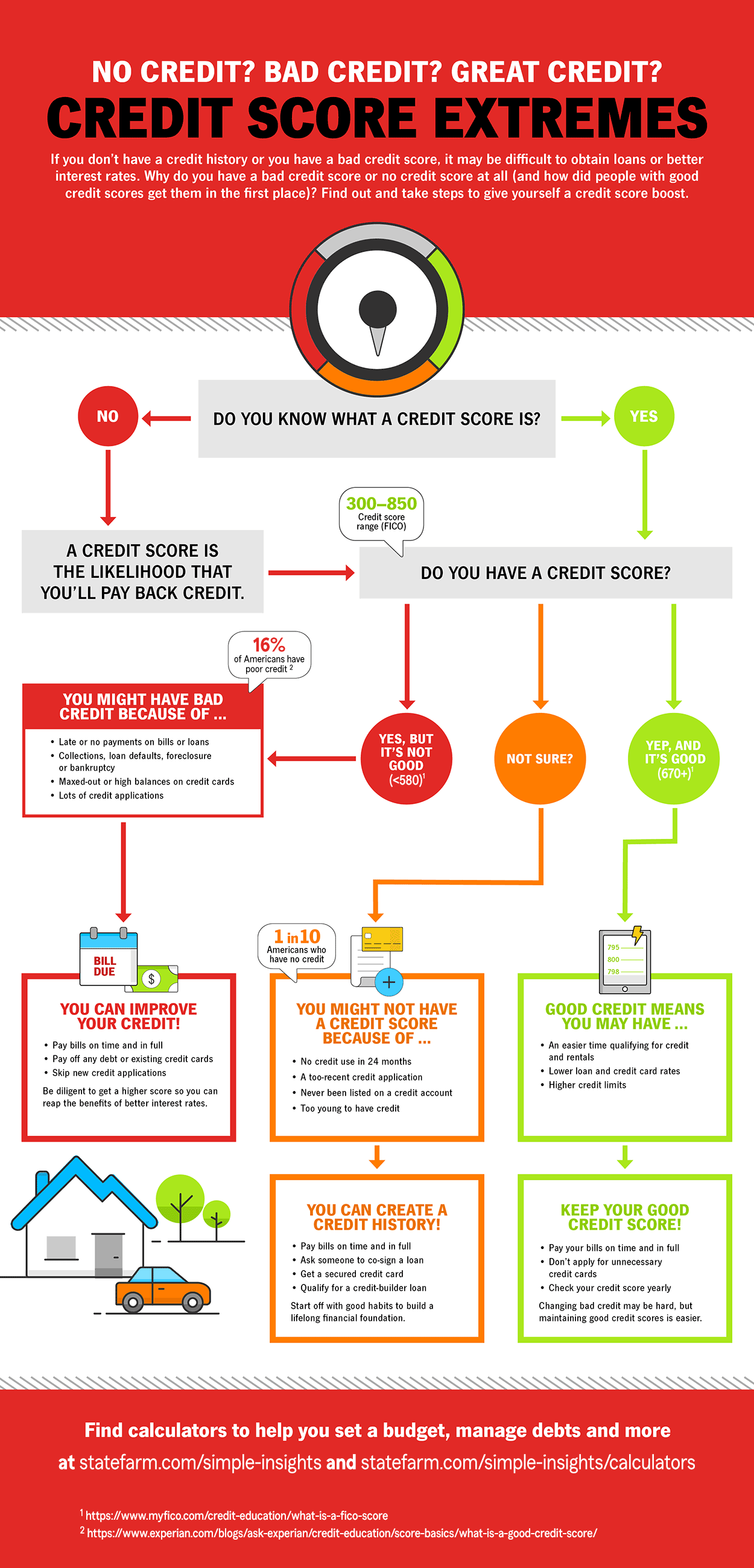

Check with your bank or lender: You can subscribe to the service. 3 reasons to keep track of your credit score 1.

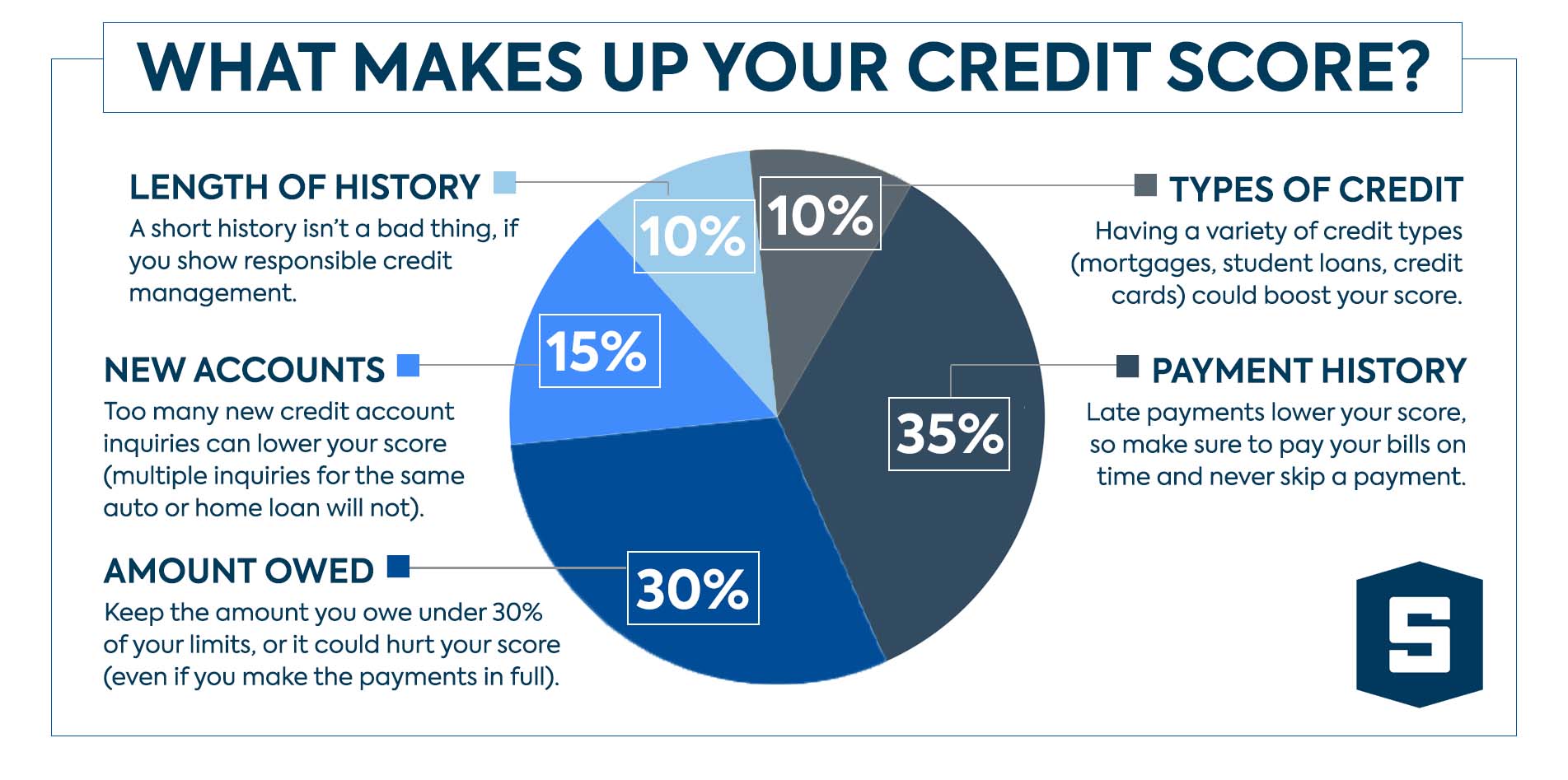

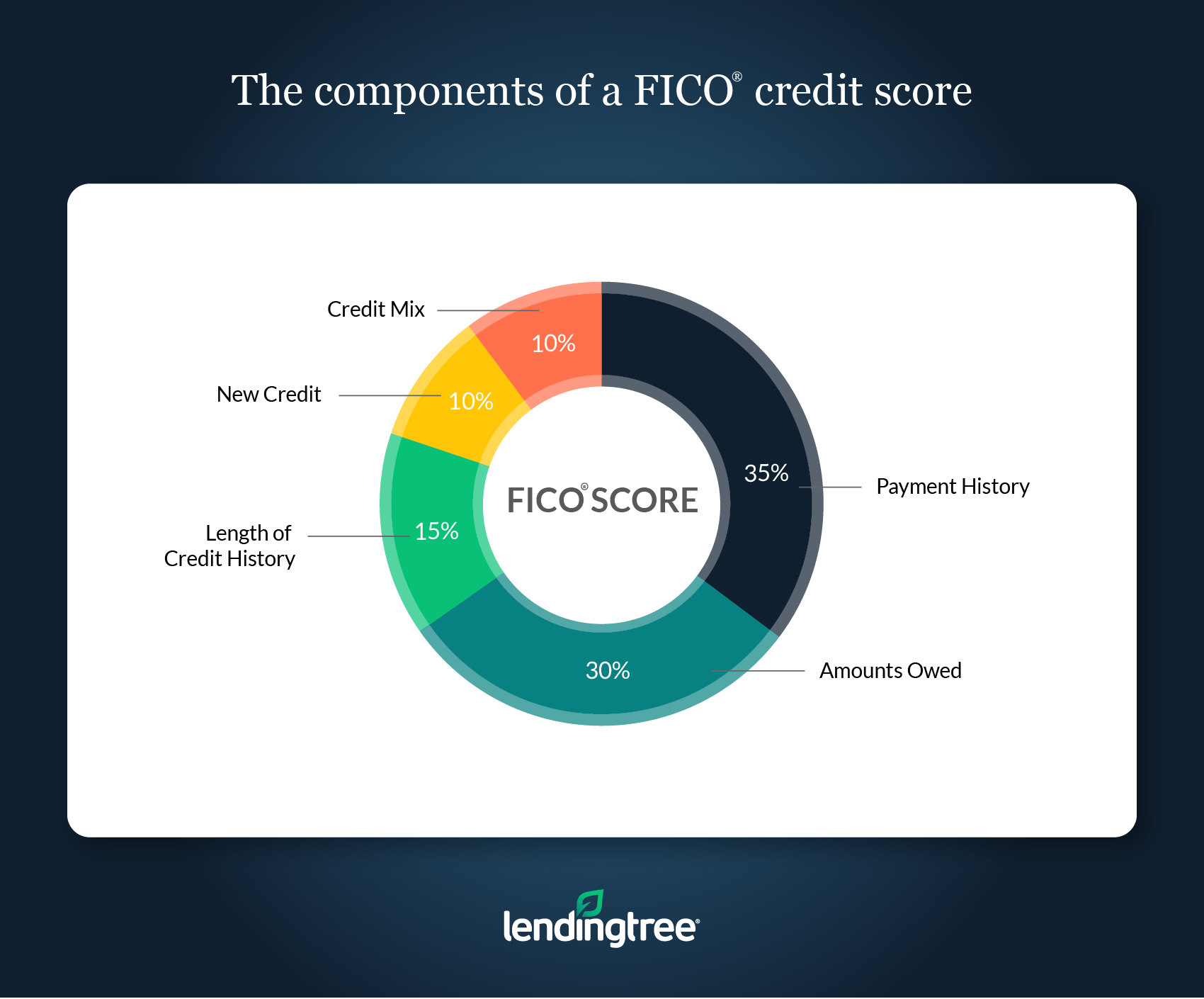

Best reasons to keep track your est free credit score. You can usually find out through your online account management portal whether your bank,. Your credit score is 30% influenced.

Ad reduce debt with bbb & afcc accredited debt consolidation companies. Convert secured cards to unsecured. Hence, it’s always crucial to try and maintain your credit score and keep improving it.

Your fico credit score includes multiple components that paint a picture of the level of risk you represent to creditors. It helps you save for future expenses. It does not matter if you are fixing your credit or maintaining your credit.