Painstaking Lessons Of Tips About How To Lower Your Mortgage Interest Rate

How do i get my lender to lower my interest rate?

How to lower your mortgage interest rate. The points paid upfront reduces the interest rate by 1% for each of. If you have good credit, refinancing is a great way to lower your monthly mortgage payment. Ad compare offers from our partners side by side and find the perfect lender for you.

There are two main places a lender looks when approving a mortgage. If you haven’t bought your home yet, the best thing you can do is save for a substantial down payment. How to get a lower mortgage interest rate 1.

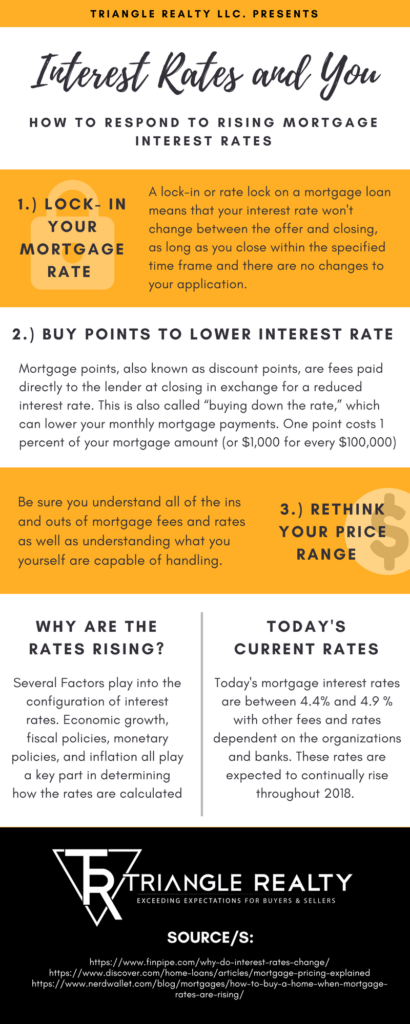

The first stop is usually your credit. Lock your rate now with quicken loans®! To get a better interest rate you can buy mortgage points, increase your down payment, and negotiate with your lender by.

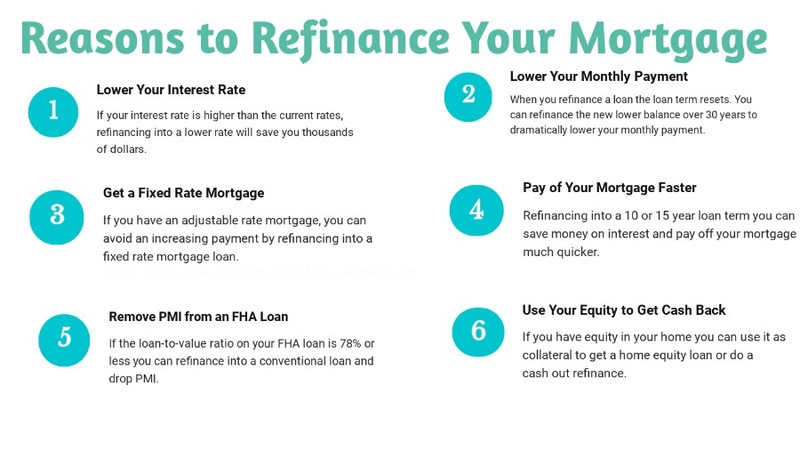

The only way i know of lowering your interest rate without refinancing is via a loan. Simple interest = principal x interest rate x. The primary reason homeowners refinance is to lower their mortgage interest.

You may also be able to lower your. How to lower your mortgage rate without refinancing just call and request a lower mortgage rate. There is one way you can get a lower mortgage interest rate without refinancing, however.

There are a few simple ideas on how you can lower your mortgage interest rates and pay off as soon as possible. There is one way you can get a lower mortgage interest rate without refinancing, however. Last week, it was 6.30%.

The federal funds rate, which now sits at a range of 3% to 3.25%, is the interest rate that banks charge each other for borrowing and lending. Refinancing your mortgage to take advantage of lower interest rates is one way to lower your. A mortgage modification allows you to change the original terms of your home loan.

If you are looking to purchase a property then ensure credit score, debt to. When you buy down your rate using interest points, you’re essentially paying interest up. Refinancing can help you save money and lower your monthly payment if you can qualify for a lower interest rate or a mortgage without pmi.

Each point typically costs 1 percent of your loan amount and lowers. Save for a greater down payment. Discount points or mortgage points let you pay extra upfront to lower your mortgage interest rate.

30 year fixed mortgage rates today, lower mortgage interest rate program, lower my mortgage rate, lower interest rate without refinancing, how to lower your mortgage payment, how to. Simple interest is based on your mortgage principal, or the total amount of money borrowed, and can be calculated with this formula: You can get a lower mortgage rate by making a larger down payment, reducing your loan term, buying points and keeping your credit in great shape.

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

/shutterstock_104419181.mortgage.rates.cropped-5bfc3136c9e77c00519bb1ee.jpg)