Fun Tips About How To Apply For A Pan Card India

Click apply for police clearance certificate link.

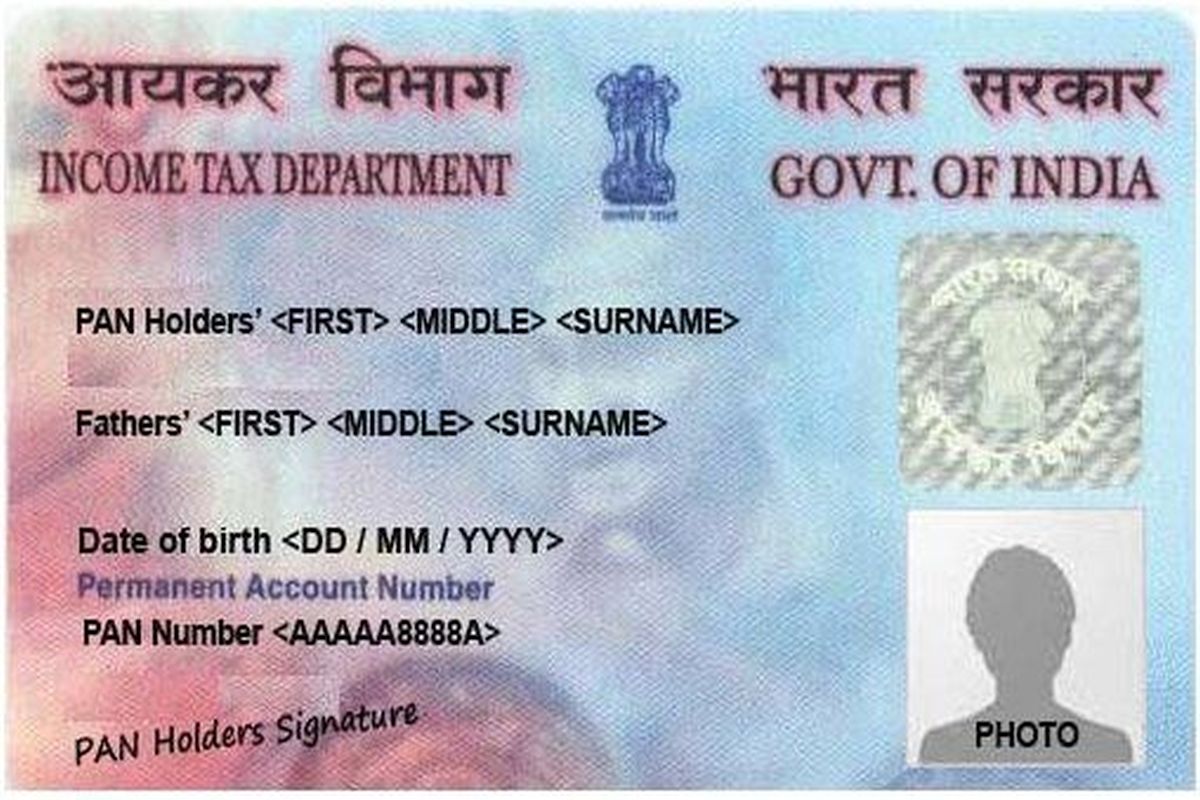

How to apply for a pan card india. Steps to apply for pan card. Choose new pan card for indian nationals from the drop. All indian citizens having the source of income and valid proofs (as prescribed by the income tax department) are eligible to apply for pan card.

Fill in the required details in the. Get the pan card delivered at your door. Application for fresh allotment of pan can be made through internet.

So to apply for pan card in india first of all you need to open the nsdl website, you can open nsdl website by using the link provided. Login to the passport seva online portal with the login id created in step 1. 161 rows online pan application of foreign citizens visit the website of nsdl for applying through online portal fill the registration form with the information and solve the captcha.

Send the docs by post/courier. Click ‘apply online’ and then download form 49a if you are an indian citizen and/or. Application for allotment of permanent account number [individuals not being a citizen of india/entities incorporated outside india/ unincorporated entities formed outside.

The following are the steps an applicant must take to apply for a pan card through nsdl: Submit proof of address with the acknowledgment form after completing the. It must be filed in the same court where the caveator.

Go to protean egov technologies limited’s (formerly nsdl’s) website to apply for a pan card online. By using the link nsdl website will get opened in new. Along with the application form, a passport photocopy and two photographs are also required.

Upload documents to validate 4. Sign & send the docs by post/courier The next step is to file the caveat at the court.

Further, requests for changes or correction in pan data or request for reprint of pan. Epan stan for electronic pan card , here you can make your digital pan card freely. Fill the online pan card application 2.

If you are an existing taxpayer and want to file a return of income in india or buy a house or even invest in india, a pan card is mandatory. The complete information, forms, guidance and appropriate links for making an application for obtaining a pan from income tax department india are provided below. Print & sign the documents 4.

The indian income tax department issues this card. The procedures to be followed to apply for a pan card are as follows: You must first submit the pan card application.

![How To Apply For Pan Card Online / Offline? [India]](https://www.techdreams.org/wp-content/uploads/2011/04/Pan_card.jpg)