Perfect Tips About How To Become A Cpa Texas

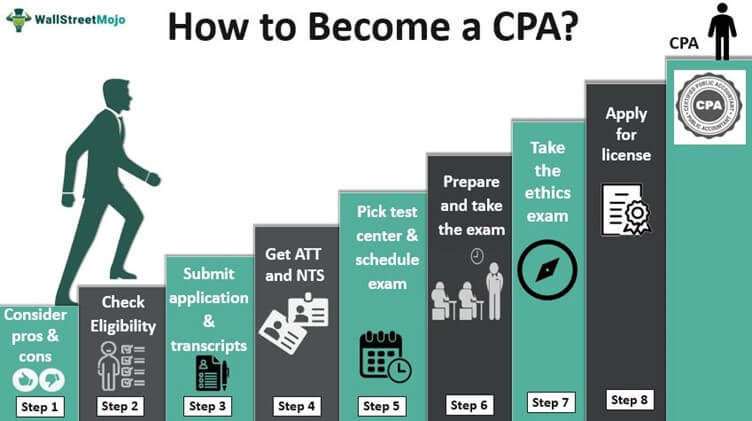

Learn the 7 simple steps to qualifying to become a licensed cpa in texas:

How to become a cpa texas. During the course of applying to the board to take the cpa examination and to become a texas cpa you will be required to provide information about yourself. There are eight main steps to complete in order to earn a cpa license in texas. To be eligible for licensure, cpa candidates are required to earn at least 150 semester hours of college credit within a bachelor’s degree program or higher before passing.

This online program will equip you with the knowledge and direction you need on the journey to obtaining a texas cpa license. The texas state board of public accountancy (tsbpa) oversees the process for becoming a cpa in the state. Most states have requirements for education, cpa exam scores, ethics and experience.

1 texas cpa exam requirements; Meet the education requirements in texas. Here are the steps to become a licensed cpa in texas:

Steps to become a cpa in texas? However, texas does have unique rules and protocols for applicants who aspire. Explore and compare our course packages.

2 educational requirements to sit; This webcast was held feb. To become a licensed cpa, an applicant must:

Steps to become a cpa in texas. You must meet the following qualifications to take the cpa exam. In texas, to become a cpa you are required to:

To meet the texas cpa education requirements to sit for the cpa exam, you’ll need a bachelor’s degree. Ad get real cpa exam questions and comprehensive explanations. Upon completing the texas state board of public accountancy’s education requirements, passing the uniform cpa exam and fulfilling the board’s experience requirement,.

File an application for issuance of the cpa certificate. First, you must complete an undergraduate degree in accounting or a relevant field. Submit your cpa exam application in texas.

In texas, to become a cpa you are required to:

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Texas-CPA-Exam-License-Requirements.jpg)

![Texas Cpa Requirements - [ 2022 Tx Cpa Exam & License Guide ] -](https://www.number2.com/wp-content/uploads/2022/04/texas-cpa-exam-requirements.jpg)

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Texas-CPA-Requirements.jpg)

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Texas-CPA-Education-Requirement.jpg)

![How To Pass The Cpa Exam & Become A Certified Public Accountant [10-Step Plan] - Beat The Cpa! 2022](https://beatthecpa.com/wp-content/uploads/2017/11/Accounting-Career-Salaries-Infographic.jpg)

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Texas-CPA-Examination-Process.jpg)

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Experience-Requirements.jpg)

![Texas Cpa Exam & License Requirements [2022] - Cpa Clarity](https://cpaclarity.com/wp-content/uploads/2021/06/cpa-requirements-texas.jpg)