Formidable Tips About How To Buy A Tax Lien Home

How do i buy tax lien properties?

How to buy a tax lien home. You’re not going to get rich by friday. Learn about tax liens and real estate auctions: The department of revenue files a lien with the county prothonotary office when an individual or.

After this, the unpaid taxes are auctioned off at a tax lien sale. This takes a little time to learn. In most states, you can typically search.

Once the auction ends, you pay whatever amount you bid in full, and viola, you will receive your tax lien certificate! At a tax deed sale, some auctions permit financed purchases, but you must prequalify beforehand. If you plan to bid on a house at a tax lien sale, you’ll need a cashier’s check.

Unlike tax lien certificate sales, tax deed sales come with the intention to purchase the property, not just the tax liability. Most houses sold at tax lien auctions are sold “as is,” and no warranties are available. If you are interested in getting started, review the following steps to buying tax liens:

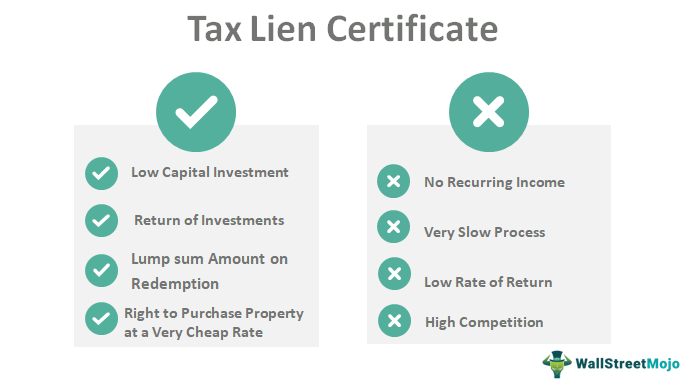

It is important to thoroughly research the house and land prior to placing a bid. If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home. There are two ways to profit from tax lien investing:.

If you have a tax lien on your property, it means the government has a legal claim to your property as payment for your. This is a public auction where the highest bidder wins. There are over a million tax lien certificates for sale in florida alone, and they can’t possibly sell them all.

Tax lien certificate sales vs. Sometimes it is the highest bidder that gets the lien against the. When a property owner fails to pay their taxes, the county has the authority to seize the property and sell it at a tax deed sale.

A lien is defined as a charge on real or personal property for the satisfaction of debt or duty. This can happen online or in a physical location. 19 sep how to pay a tax lien on your property.

There are a number of.

/GettyImages-1137448188-45959ad13a7f4625b3969fe1fb9295af.jpg)